Excitement About Small Business Accounting Service In Vancouver

Wiki Article

The 7-Minute Rule for Vancouver Accounting Firm

Table of Contents3 Easy Facts About Tax Accountant In Vancouver, Bc DescribedSome Known Details About Tax Consultant Vancouver Getting My Small Business Accounting Service In Vancouver To WorkThe Definitive Guide to Tax Consultant VancouverHow Tax Accountant In Vancouver, Bc can Save You Time, Stress, and Money.The Best Guide To Tax Accountant In Vancouver, Bc

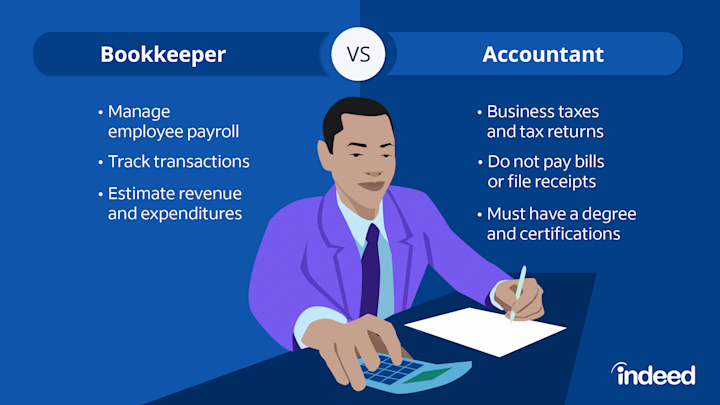

Here are some benefits to hiring an accountant over a bookkeeper: An accountant can give you a thorough sight of your service's economic state, in addition to approaches and also recommendations for making economic decisions. On the other hand, accountants are only in charge of recording economic transactions. Accounting professionals are needed to finish even more education, qualifications as well as work experience than accountants.

It can be difficult to gauge the ideal time to employ a bookkeeping professional or accountant or to identify if you require one whatsoever. While several small companies employ an accountant as a professional, you have numerous choices for managing monetary jobs. For example, some local business proprietors do their own accounting on software application their accounting professional advises or makes use of, offering it to the accountant on an once a week, regular monthly or quarterly basis for action.

It might take some background study to discover a suitable bookkeeper because, unlike accounting professionals, they are not required to hold a professional qualification. A strong endorsement from a relied on colleague or years of experience are essential variables when working with an accountant.

9 Simple Techniques For Cfo Company Vancouver

For tiny companies, adept money monitoring is a vital facet of survival and growth, so it's smart to collaborate with an economic expert from the beginning. If you favor to go it alone, take into consideration starting out with bookkeeping software application and keeping your books thoroughly up to date. In this way, ought to you need to hire an expert down the line, they will have visibility into the complete financial history of your company.

Some source interviews were performed for a previous variation of this write-up.

Outsourced Cfo Services Fundamentals Explained

When it pertains to the ins and also outs of tax obligations, bookkeeping and also finance, however, it never ever hurts to have a skilled expert to rely on for support. An expanding number of accountants are additionally dealing with things such as capital estimates, invoicing and also HR. Ultimately, many of them are taking on CFO-like roles.Small company proprietors can expect their accountants to help with: Selecting business structure that's right for you is necessary. It influences just how much you pay in tax obligations, the documentation you require to file as well as your personal responsibility. If you're wanting to convert to a various service structure, it might lead to tax obligation effects and also various other complications.

Also business that are the very same size and sector pay extremely different quantities for accountancy. Before we enter whats a accountant into buck figures, let's discuss the expenses that go right into little business bookkeeping. Overhead costs are costs that do not straight develop into an earnings. Though these prices do not exchange cash money, they are necessary for running your organization.

The 45-Second Trick For Virtual Cfo In Vancouver

The average cost of accountancy services for little organization varies for each one-of-a-kind circumstance. The typical monthly accountancy costs for a small company will rise as you add more services as well as the tasks get more challenging.You can tape-record transactions as well as process payroll using online software. You get in amounts right into the software program, and the program calculates overalls for you. In some instances, payroll software program for accounting professionals enables your accountant to offer pay-roll handling for you at very little additional expense. Software program options can be found in all forms as well as dimensions.

:max_bytes(150000):strip_icc()/Accounting-error-4202222-recirc-FINAL-30dfa8eb28224cfb9ef63a72f5eaa5e8.png)

The Single Strategy To Use For Vancouver Tax Accounting Company

If you're a brand-new company owner, do not forget to element accounting expenses into your budget plan. the accountant synopsis If you're a professional owner, it may be time to re-evaluate bookkeeping prices. Management prices and also accounting professional charges aren't the only accounting expenditures. tax consultant Vancouver. You need to likewise consider the results accountancy will certainly have on you as well as your time.Your time is likewise important and must be considered when looking at bookkeeping prices. The time invested on accounting tasks does not generate earnings.

This is not meant as lawful guidance; for additional information, please click on this link..

The Pivot Advantage Accounting And Advisory Inc. In Vancouver Ideas

Report this wiki page